Our Q&A series is an opportunity for our European team, headed up by Dilan Omari to discuss all things PropTech, Start-ups, and Career with different founders from across the continent. Each week we will ask PropTech innovators burning questions and quiz them about their product, we hope you find it insightful and enjoy getting to know the founders as much as we have.

This week we have been in touch with Deborah Fritz, CEO & Founder, MYRE

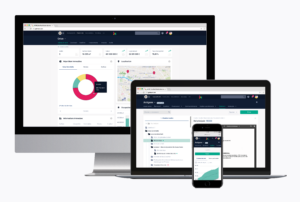

MYRE puts efficiency into real estate management. We provide an integrated solution empowering real estate players to make smart, data-driven decisions. In particular, MYRE’s asset monitoring app centralizes, checks, analyzes, and forecasts operational, financial and legal data for real estate players. More than a software, MYRE REAAS (Real Estate As A Service) offer supports our customers throughout their digital transformation.

Thanks to MYRE’s technology and in-house experts, real estate professionals can focus their time on creating value in their portfolios. MYRE makes reliable property information available in real time, allowing faster, smarter decisions to maximize investment returns. The MYRE app is a complete tool supporting all management real estate players throughout an asset’s entire lifecycle, from acquisition to disposal. Other tools can be integrated seamlessly with MYRE, enabling professionals to plug into our unique system at any stage to make the most of their data.

After starting off my professional career in banking, I entered the world of real estate where I held the position of CFO for France of one of the major US real estate investment funds: Beacon Capital Partners. I was managing €2 billion in AuM without any specific management tools, unlike my experience in the banking industry. MYRE is the asset management tool that was lacking in the real estate industry.

In this entrepreneurial adventure, I started with two other co-founders: Isabelle Cohen, COO and Ariel Boukobza, CSO. Isabelle has a strong background in management and real estate legal matters, whereas Ariel is our sales guy, after working in tech companies such as SAP.

I am the CEO and founder of MYRE. My mission is to bring efficiency into real estate management. We estimated that 30% of the time spent by real estate players was dedicated to collecting and checking their data. With MYRE we empower real estate professionals to focus on creating value in their assets by making smart, data-driven decisions.

The real estate industry lacked any tools for managing their assets. For more than ten years, real estate has been moving in line with other financial asset classes demanding more professionalism from people and tools, as well as more sophisticated reporting and financial modeling. Real estate players were mainly working with Excel or with non-communicative, inadequate, and disparate tools. They didn’t have a global, reliable, real time vision over their portfolios. Hence, their decisions were based on a blurred perception of their assets’ reality.

I created MYRE in 2016 to build a tool that I would want to use as a real estate professional. MYRE is an integrated tool bringing the players under one roof in order to focus on creating value from real estate assets by working more efficiently.

MYRE is more than a software program. We also provide services through our real estate expert team to support and help our clients. In a way, we become part of their team by providing what we call REAAS: real estate as a service.

Unlike the United States, the European market is fragmented. This is one of the most challenging aspects because we target markets that are legally disparate. Consequently, we need to design a solid, complete model that suits several market typologies.

We know that in Europe the three main cities hosting the greatest number of PropTech startups are London, Paris, and Berlin. We are currently focusing our expansion on the UK and German markets. The next step will be to strengthen our presence more globally throughout Europe.

Our platform can be adapted to any kind of real estate assets such as offices, logistics, retail, residential, as well as to any country. MYRE currently manages the real estate data of assets located in more than 15 countries.

Very few tools on the market can globally process data across all real estate management needs. Thanks to MYRE’s integrated solution, we provide a comprehensive, reliable view of a portfolio in real time thus empowering real estate professionals and optimizing asset performance.

Our long-term plan is to become the integrated solution of reference for real estate management on the European market. The product aims to afford a unique platform to all real estate management players: property managers, asset managers, fund managers, and institutional tenants, to cover all their needs from a single tool.

Our first objective is to deploy our solution internationally in Europe by focusing on our expansion in the UK and Germany over the next two years.

To that end, we plan to recruit a workforce in the UK and Germany from September to start expanding our presence in Europe. We also intend to double our workforce over the next two years and our revenue every year.

The four main areas of PropTech that investors are focusing on include: new ways of using real estate, digitalization of buildings, data collection, and ESG.

Unlike other industries, real estate is late in its digitalization. A lot has changed in the last few years and new trends are appearing.

These new trends have been influenced mainly by environmental challenges and the impact of the Covid-19 crisis.

New ways of using real estate are emerging. As we observed during the Covid-19 crisis, flexible workplaces are now common at most companies. Offices as we conceived them in the past are no longer the standard because we are changing the way we work. Spaces need to evolve and investors are using more and more PropTech solutions to adapt them to our current needs.

In addition, in a market characterized by uncertainty, players need more transparency and fluidity of information to react more quickly and confidently to external fluctuations.Investors want to invest in more reliable asset classes, while avoiding the risks by better managing their portfolios. Their stakeholders too want to feel more confident thanks to better control over information. For that reason, they need to know perfectly the asset they’re investing in, through reliable data and reports. Property values will be enhanced also from the data and the ability to use such information.

The next step will be to bring AI into the data to automate the process thus creating even more efficiency in the way our assets are managed. However, before using AI, we need to obtain quality data. This is one of the major challenges we are facing with our clients. In fact, when a client starts using MYRE, we can find 30% of errors in the data they are using. First, we have to support an adaptation to change by creating real data governance for our clients.

Regarding ESG, investors are required to respect very strict regulations. They need to improve control over their assets by producing detailed reports to enhance their sustainability. ESG will be one of the major challenges over the next few decades for Europe and worldwide.

There are many more changes in real estate than in other industries because we are creating the cities of tomorrow with many challenges ahead. It is more than just providing data-science, smart buildings, artificial intelligence, metaverse, and so forth. Real estate is not just an asset like those in the finance industry. It is alive and includes irrational facts. We have to take all this into the picture. Together we are contributing to tomorrow’s world by making our buildings and cities better suited to our next challenges with the help of technology, not the other way around.

There is a wide market for PropTech in Europe. While the U.S. market already has many PropTech solutions, the European real estate market has been slow to initiate its digital transformation, rooted in stringent rigidity and reluctance to change. But PropTech is growing more and more in Europe. As an example, PropTech in France has reached the 3rd place, after entertainment and fintech, in the ranking of industries raising the most funds in 2021. The market is finally initiating its digitalization process bringing real estate into the 21st century.

LMRE are specialist PropTech recruiters, if you need help growing your business or making any key hires please get in touch via the form below!

"*" indicates required fields